At the moment the entire crypto market is down, Bitcoin has plunged and everything else followed, but I’m not worried because I’m happily earning crypto by doing basically nothing, and in this article I will explain how to earn passive income with crypto easily. How much can you make though? Well it depends on a number of factors, which I will explain below, but you can actually earn hundreds of percent APY even if the price of the coin doesn’t go up!

Before you can earn passive income from crypto, you will of course need to actually obtain some crypto. There are various ways to do that such as buying on an exchange like Binance, having some sent to your wallet for some reason, winning it in crypto games etc. But all that is not the topic of this article, so I will assume you have some already or know how to get some, but if you are just getting started in crypto you may be interested in this beginners cryptocurrency article.

In this article the crypto currencies I will cover include Million, DogeDash, and using QuickSwap, Binance, and MillionPool, but you can do it with many in a similar way with other coins and platforms.

Staking

Staking is, in a way, like putting money into a savings account in your bank, and earning interest. In some cases you have to “lock” your money (crypto) for a period of time and if you take it out early you may pay a penalty. Typically staking pays far higher interest rates than any bank savings plan though.

When you stake crypto, you usually earn interest or rewards in that same crypto, so for example if you stake Million token on MillionPool you will earn Million token. However there are some which pay interest in another coin – an example of that is VeChain (VET) which can pay in rewards in VeThor (VTHO), or Shiba Inu (SHIB) which pays out in various currencies, such as Bone, when you stake on ShibaSwap, and when staking on QuickSwap you can earn Quick (or dQuick) – but more on that later.

Staking is not available for all cryptos, it is generally for those that use “proof of stake” to validate transactions on the blockchain. Bitcoin for example uses “proof of work” instead, which is where “mining” comes to play.

Here’s a few places you can easily stake to earn passive income:

Million Pool

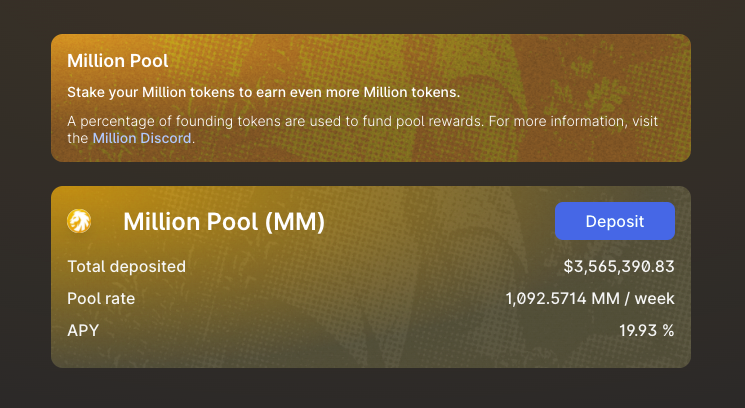

As you can guess from its name, Million Pool is for staking Million token (MM). It pays a reward rate of up to 20% (20.42% at time of writing), and the payout is in Million token. There are millions of dollars worth of Million staked in that pool already and it was created by TechLead, the founder of Million token, who is well known and not someone you have to worry about doing a “rug pull” or anything shady. This is a relatively safe place to stake.

Just connect your wallet (such as MetaMask), click on Deposit and approve transactions then click again to actually deposit, select how much you want to stake, and follow the prompts. Once staked, you will see your MM rewards rolling in continuously!

One thing to be aware of with Million Pool is that the staking only works with MM on the Ethereum network, which means there are ETH fees to pay for depositing and withdrawing, which can be expensive. As a result of these ETH fees, it is not advisable to stake a small amount of MM since you would lose out when paying the fees. I would suggest staking at least 200 MM, although if you time it well and gas fees are low, you could get away with staking a smaller amount. For those who hold a big bag of MM on Ethereum, this pool is a great way to easily earn passive income.

If you have MM on Polygon network instead of Ethereum, then keep reading to learn how you can stake and earn with that as well.

Over time, as more people stake in the pool, the APY may drop although so far TechLead seems to be keeping it topped up nicely. How long the pool will run for is currently unknown, but it is common for staking pools to run for at least 2 months and then be extended if there are funds remaining for rewards. This pool could be running for another 2 months or maybe even 6 months or more, but the sooner you get in the sooner you can earn rewards while they are available.

DogeDash

DogeDash is a “play to earn” game with its own crypto on the BSC blockchain, which you can buy or even win by playing the game. It’s just getting started but already DogeDash token is rapidly growing in value and holders.

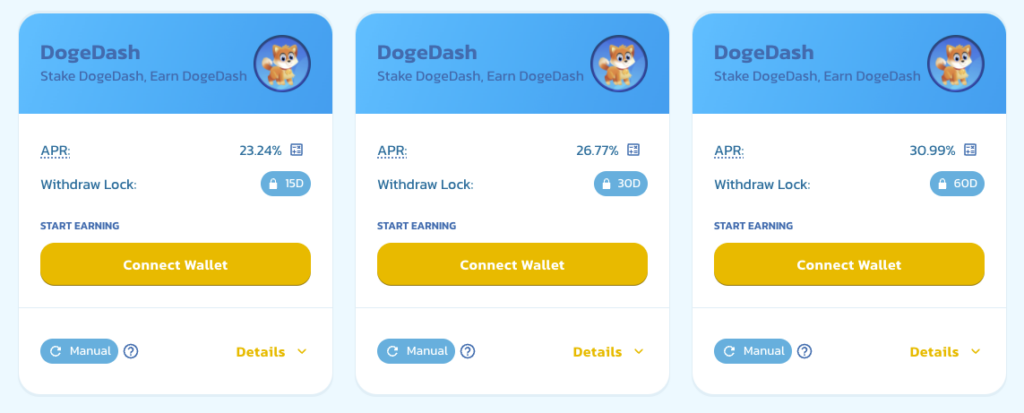

Along with the game, they also recently launched a staking platform so you can earn up to 30% APR just by depositing your DogeCash and locking it there. The longer the lock, the higher the rewards and to get 30% (the current rate) you would need to lock for 60 days. If you are not keen on locking for so long, you can still earn around 23% APR with just a 15 day lock!

The way to do it is simple, and very similar to staking in the Million Pool mentioned above:

- Make sure you have some DogeDash in your wallet

- Click Connect Wallet (such as MetaMask)

- Follow the prompts to sign/connect your wallet

- Click on Enable under the staking pool you want (such as the 60D lock)

- Follow the prompts again to authorize transactions

- Choose the amount of DogeDash you want to stake and follow the prompts again to complete the staking process

That’s basically all there is to it. Your DogeDash is staked and you will see the rewards rolling in continuously!

Shiba Inu

Shiba was called the Doge Killer and is a massively popular meme coin which has been copied by many other coins, and it saw a big surge in price recently. They also have their own swap site shibaswap.com which allows you to stake and earn more Shib and other coins such as Bone. The downside is that it is on Ethereum network and the fees are just insane, which means unless you are dealing with larger amounts, it is simply not worth it to stake there these days.

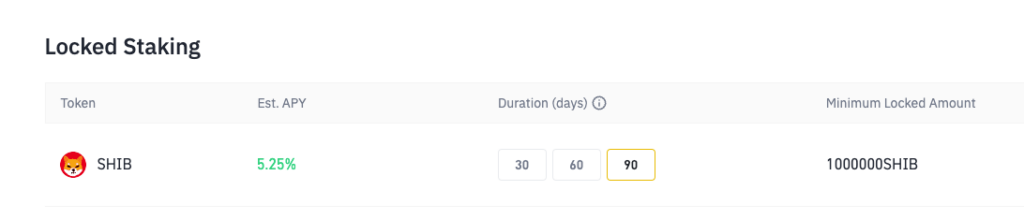

However, all is not lost since Shib is on most of the big exchanges now and can be staked on those instead. On Binance for example, you can earn 5.25% by staking Shib if you lock it for 90 days, or 4.12% if staked for 60 days. The fees are relatively low and so this is a good choice for staking smaller amounts.

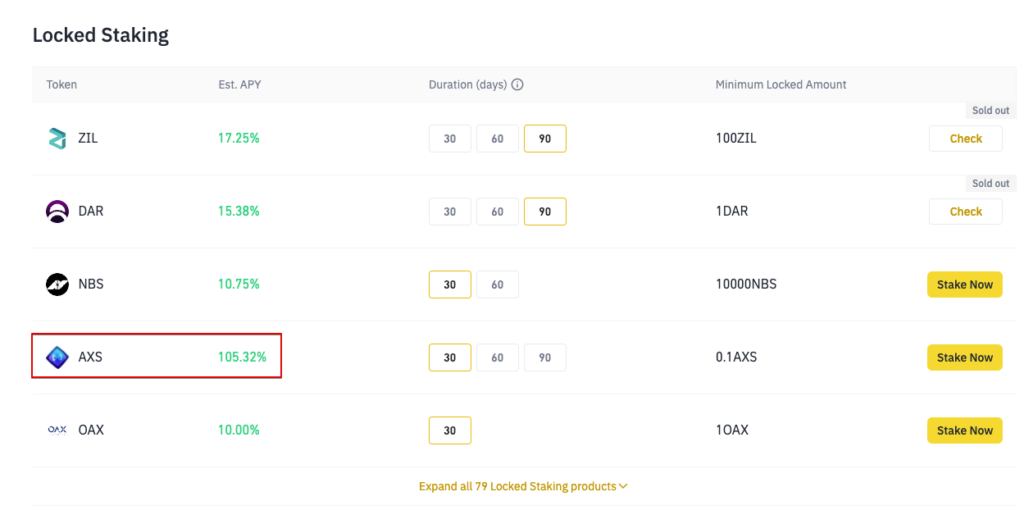

There are many other coins you can stake in Binance, and some pay very high APY rates, such as AXS which currently offers over 100% for just a 30 day lock!

In general, Staking is a nice and easy way to earn passive income from crypto which may otherwise just be sitting in your wallet doing nothing. Some coins on some exchanges can offer very high APY rates for short periods, as little as 15 days in some cases, while others required 90 day locks to get the higher rates.

Make sure to research any coins you plan to stake, to get a better idea of how stable they are and how likely they are to still exist by the time your locking period ends!

Liquidity Farming

Regular staking, as described above, is a great way to earn basically free money/crypto, but there are other ways to generate passive income from your crypto, albeit with higher risks. Once such method is Liquidity Farming or Mining. In order to do this, you need to provide liquidity in the form a pair of coins, and then stake the liquidity pool tokens. This may sound a little bit complicated but it’s actually fairly simple, and I will describe one such example using Million token on QuickSwap: https://quickswap.exchange/#/quick

As you can see from the screenshot below, you can earn approximately 400% from this! In this example the liquidity pair is Million token and USDC, which means one side is a stable coin (but doesn’t have to be). As it is a pair of coins, you need to provide an equal value for each side – so if you have $1000 worth of Million, you must also provide $1000 of USDC.

Over time the value of Million will fluctuate and as that happens, the pool will automatically balance itself by buying and selling Million. This activity presents some risk, which I will describe in more details, later in this article.

You may have noticed from the screenshot that the income you earn is made up of Rewards + Fee APY. The fees are what you earn from transactions when people are trading Million/USDC on QuickSwap. The rewards are gravy on top which are funded by QuickSwap and Techlead (Million founder). How much you earn depends on your share of the pool, so as more people join the pool, the less you will earn from it. Typically this means when a staking pool is first launched, the APY rate is very high and this quickly drops.

Add Liquidity

To get started with this, you need to add liquidity to the MM-USDC pool, which you can do here: https://quickswap.exchange/#/pool

Or at the top of the page, click on Farms > LP Mining

Just follow these simple steps:

– Connect your wallet

– Select MM

– Enter the mount you want to include (or click Max)

– The form will automatically show how much USDC you need – if you do not have enough USDC in your wallet, you can either buy some more, or lower the amount of MM until the value matches what you have in USDC.

– Click Supply and then Confirm Supply and then confirm the transaction in your wallet.

Make sure to follow the prompts along the way and then you will have your liquidity tokens for staking.

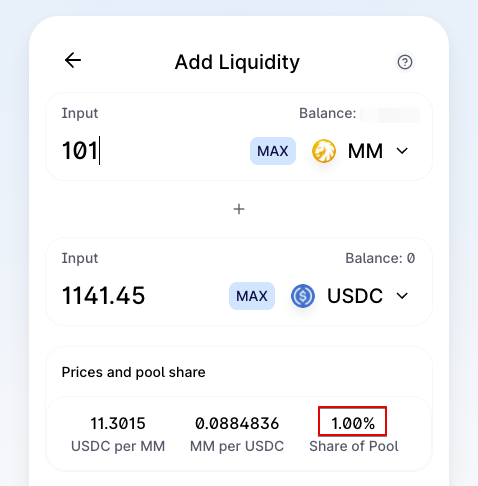

You can see in the screenshot below for example, that if you enter 101 MM you would need 1141.45 USDC, and that would give you a 1% share of the pool (at time of writing).

Stake LP Tokens

The next step is to stake those tokens acquired above:

– Go here: https://quickswap.exchange/#/quick

– Pick the pool you want to stake – in this example it is MM-USDC. If you do not see it, try holding down the shift key while reloading the page in your browser.

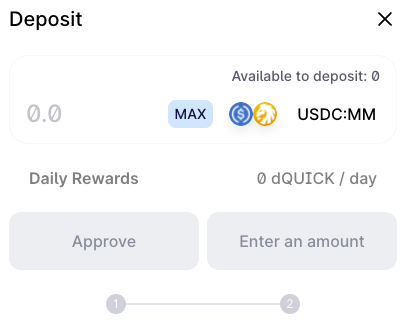

– Click Deposit/Deposit LP tokens

– Enter an amount of MM:USDC liquidity tokens (or just click Max)

– Click Approve and then Sign on your wallet

– Click Deposit and then Confirm

Now your liquidity tokens are staked and you are earning Quick tokens (or dQuick). You can claim these any time you want without withdrawing your stake – just click the “Claim” link that displays there. I do this every day and then simply swap the dQuick for more Million token, but you can leave it in the pool and claim once a week or month or whenever you want. The fees on Polygon are negligible so it’s no problem to claim your rewards frequently.

As I mentioned, I typically use the dQuick to buy more MM, but you have other options. You could trade it for another coin, or simply leave the dQuick in your wallet for the future. But you could also take it a step further and stake that dQuick in a Syrup pool which will earn you more Million token as reward for staking!

The process for staking in Syrup is straightforward:

– Find the pool you want (such as MM)

– Click Deposit (note that you can only deposit dQuick)

– Choose the amount, approve, confirm etc.. just follow the prompts.

Now you will see the MM rolling in every day. It is important to note that the Syrup pool has an expiry date, so in the screenshot below you will see it says 55 days and 22 hours remain, so it’s best to get in early to earn the most rewards.

Farming DogeDash

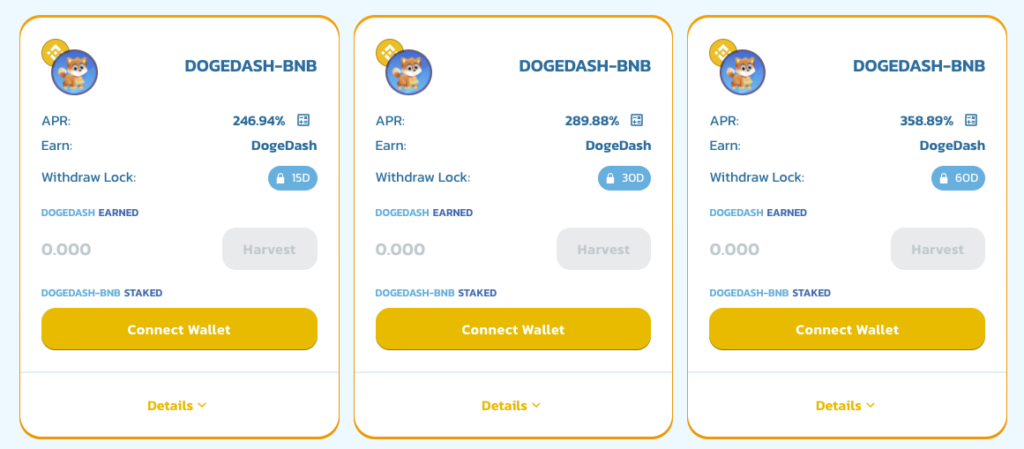

QuickSwap is a great place to do yield farming or liquidity mining with a range of tokens, but there are other places that can also earn a nice passive income. Once such example currently running is DogeDash Farms. As mentioned earlier in this article, you can easily stake your DogeDash and earn around 30%, which is certainly a nice rate, but you can earn over 300% by farming instead!

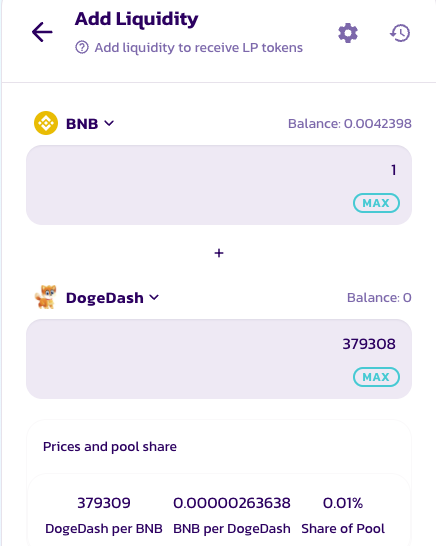

DogeDash is on the Binance Smart Chain (BSC) network and to get LP tokens, you will need BNB, so the liquidity pair id DogeDash-BNB.

Assuming you have some BNB tokens and some DogeDash, you can get your liquidity token pair on PancakeSwap here: https://pancakeswap.finance/add/BNB/0x7AE5709c585cCFB3e61fF312EC632C21A5F03F70

Once you have you DogeDash-BNB liquidity tokens, you can stake them:

– Go here: https://staking.dogedash.com/farms

– Pick the staking duration you want, such as 30 days or 60

– Click on Stake LP and follow the prompts (approve, confirm, sign etc)

Now you are earning DogeDash from your pooled token pair!

IMPORTANT: When you stake your tokens, they are locked for the duration you chose and cannot normally be removed until the end of the period, so be aware of that!

Risks

Investing in crypto is risky, and I’ve said many times on this blog – only invest what you are prepared to lose, and in fact it’s probably good to assume from the start that you will lose the money you invest in crypto, then if you actually make money, it’s a bonus!

You should always research any coin you plan to buy and research again if you plan to stake or farm. A coin such as Million by a fully doxxed founder such as Techlead is a safer bet than many, but there are still risks and I will cover those here:

Impermanent loss – when you put your crypto into a liquidity pool, such as when LP farming/mining, you are typically creating a coin pair with both sides having an equal value. For example with the MM-USDC pair, if you put in 1000 USDC, and if MM was valued at $20 at that time, you would need to put in 50 MM to match the USDC side.

The risk with this, is that the price of the coin will change over time and it can go up in value or down. If the coin value goes up a lot you are still stuck with the original value and you may have been better off just holding it rather than locking in a pool.

Small fluctuations in price are not a problem, and can be made up for by the fees and rewards you earn from farming the pool. However there comes a point where those rewards are not enough, and this is where you start to lose. So if the coin you staked goes to the moon, you could be left with nothing but a few USDC.

Here’s a handy calculator which can help you see how that works: https://dailydefi.org/tools/impermanent-loss-calculator/

Rug pulls – this happens quite often with newer coins, when unscrupulous people will pump the price of a coin through the roof and then pull all their funds or liquidity out, causing the price to crash, and the remaining holders are left with nothing but a worthless coin. Do you due diligence on any coin you are interested in, and be aware that most new coins have a huge spike in price when they first launch anyway, so it’s not so safe to buy in while it is already way up – buy early or buy the dip when it has crashed way down after the launch hype fades (as long as it’s still going and not actually a scam coin!).

Hacks and Smart contract bugs – smart contracts which govern how a coin behaves, how it is divided up and what can be done with it on the blockchain, are complex bits of code and have been known to be exploited by hackers who find a way to drain all the funds out. Sometimes it may just be a bug which wrecks the value, without any malicious intent. Either way, it is best to only invest in coins or tokens which have been audited by a reputable 3rd party such as Certik, although that is still not a 100% guarantee.

You can see here the Certik report for Million token.

Other things to be aware of are the fees involved (particularly with Ethereum network) and expiry of pools – you may find that the pool ends before you have earned enough to make a profit after paying the ETH fees! This is less of a problem on Polygon or BSC though.

If your chosen crypto is locked up in a staking contract for 60 days, and in the meantime the coin value moons and you are unable to cash out in time to benefit, that is another risk to be aware of. Similarly if the price crashes and you are left holding coins worth a fraction of their former value and you cannot sell them even if you wanted to, you will also be less than happy with your investment.

Always remember the rewards or interest you may earn on crypto are paid in crypto, not is USD or Euro or any “real” money, and the value of that crypto can rise or fall dramatically which can quickly wipe out your earnings.

It may be worth holding two separate “bags” of coin – one for staking/farming, and another for trading in case opportunity knocks.

The future of crypto is unknown and the entire market could crash (as it has as I write this article), and never recover, or it could recover quickly or gradually over the months and years ahead. There could be new regulations brought in which make it harder or even impossible for many people to invest in crypto, or it could be outright banned (as in China now). So be aware of these risks and don’t be surprised if the whole thing disappears along with your money. Do your own research and decide if the risk is worth it for you – there is risk in crypto, don’t ever think there isn’t!

If you still believe it is worth the risk, making passive income by staking and farming is great, but don’t put all your eggs in one basket.

Leave a Reply